Life in the Fast Lane

National Western Life took control of their e-Application workflows with the FireLight Self-Management Admin System

Client Success Story

National Western

Life Insurance Company

National Western Life Insurance Company provides high quality insurance products that meet the financial security needs of well-defined market segments.

CHALLENGE:

Slow reaction time to needed changes to forms and rules within e-Application solutions.

SOLUTION:

FireLight

RESULT:

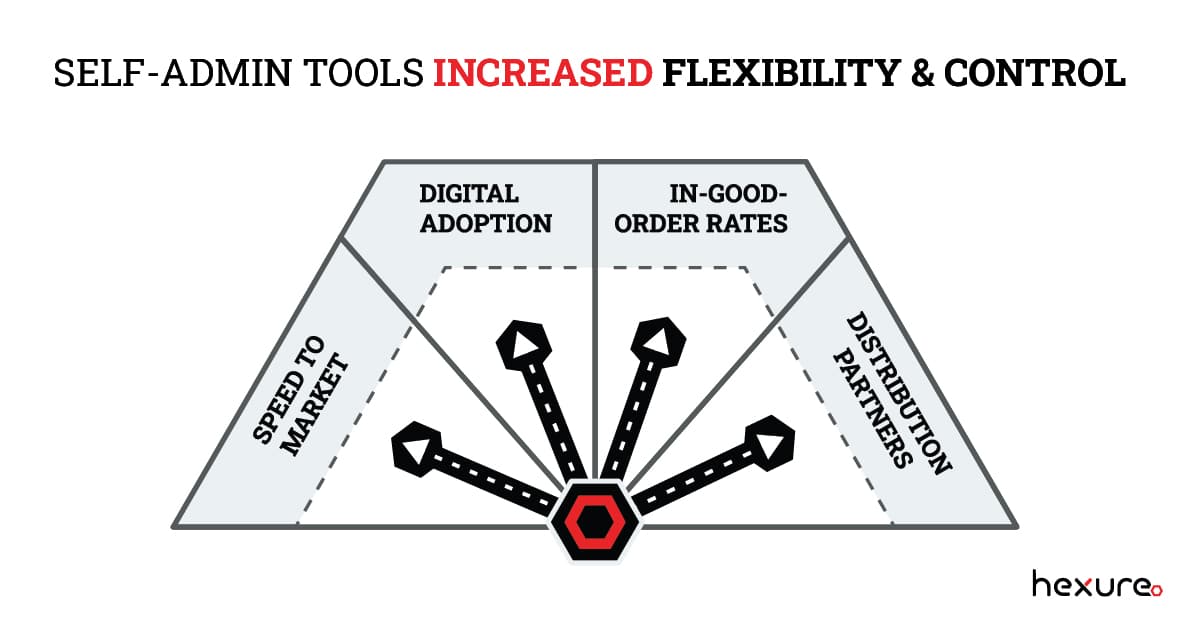

- Improved the speed of form changes by as many as five weeks

- Increased adoption of digital solutions

- Decreased NIGO rates

- Gained maximum flexibility and control of workflows

- Achieved a consistent process for managing both life and annuity products

Hurry up and wait. It is an all too familiar refrain for carriers maintaining digital e-Application solutions. And, it can be a costly wait. Carriers need to create new forms and rules quickly. Adjusting to new regulations, making changes to existing products and getting new products to market all require the same thing to be successful—speed.

Unfortunately, speed isn’t always an option when relying on the vendor for changes. The carrier is in a holding pattern while the vendor completes their custom update. Or worse, the vendor includes it in a scheduled release. In the meantime, the carrier’s distribution partners revert to paper forms. This negative experience reduces distributor adoption of e-Application software. For a digital-focused carrier, it is frustrating and delays their business goals.

National Western Life had been repeatedly disappointed by this experience. With frustrations stacking up, they decided to seek out different sales automation solutions. Their journey eventually led them to FireLight and the liberating benefits of self-administration.

National Western Life is no stranger to innovation. They have offered a wide portfolio of life and annuity products since 1956. Their habit of adopting the latest technologies has contributed to their longevity. They embraced the insurtech revolution. They used digital e-Application solutions from major vendors. Their goal was to streamline their workflows. So, they could add value for their distribution partners and achieve straight-through processing. This e-Application software digitized their products and made their processes more efficient. However, National Western Life discovered a prominent downside to their current solutions. Possibly, a deal breaker.

“We’ve used a lot of different platforms. In every case we came up against the same challenges, including slow reaction time to needed changes,” said Chad Mercer, VP of Sales Development and Analytics at National Western Life. “It could take up to six weeks to get an update to our forms from a given vendor. When the state says you need to be compliant to regulatory changes within four weeks—then we have a problem.”

The business relationship management team at National Western Life acts as an internal-to-external liaison. They faced the brunt of this friction. This team completes the product updates and new product implementations. National Western Life depends on them to do so quickly. But, relying on the vendor for these changes involved several frustrating speed bumps.

National Western Life dealt with slow rollouts due to vendors’ scheduled updates. Also, communication with various vendors was often clunky and time-consuming. Sometimes vendors lacked the product knowledge to create compliant rules and forms without help from the National Western Life team. The back and forth only added to the delays in implementation.

“Delays in implementing product updates are frustrating for our partners. Distribution partners we worked hard to convert to e-Application would suddenly be forced back to paper,” said Mercer. “Sometimes you get that distributor back into your digital platforms and sometimes you don’t. Either way, you have a frustrated partner.”

The National Western Life team knew the benefits of digital e-Application were clear. They also knew relying on vendors for administration tasks was not a viable long-term solution. Something had to change.

"We wanted a way to make our agent experience the best it could be, and FireLight was the answer."

~ Chad Mercer, VP of Sales Development and Analytics at National Western Life

Taking Back the Wheel

National Western Life was evaluating several different solutions. Then, they heard about other carriers’ positive experiences with FireLight. It was enough for the team to pursue an RFP with [Hexure]. In 2018, the carrier decided to move some of its annuity products to FireLight. They have added products—including life—every year since.

What was the deciding factor? Self-administration capabilities.

“We felt the ability to run admin on our own forms would unlock the potential of digital sales automation for us,” Mercer remarked. “We wanted a way to make our agent experience the best it could be, and FireLight was the answer.”

[Hexure] built the forms and rules for their first products within FireLight. After a while, National Western Life became familiar with FireLight’s self-administration system. They started using the tool to its potential.

“The self-admin tool opened up a whole world for us,” said Nick Jellings, Senior Sales Development Analyst at National Western Life. “This was the first time we had complete control of our forms and rules. Suddenly we had the ability to react to regulatory changes when we needed to. We could roll out new forms in days rather than weeks or months.”

Life in the Driver’s Seat

Today, National Western Life manages multiple life and annuity products in FireLight. They plan to add even more. They do most of their forms and configuration work themselves. They are also able to manage their own deployments.

National Western Life’s confidence in FireLight comes from the results they have seen thus far.

“FireLight adds so much value from a new business and processing standpoint,” said Mercer. “Adoption rates of our digital solutions from distribution have improved to show it.”

NIGO rates have gone down thanks to several of the platform’s features. For starters, National Western Life can now build its own rules using the self-management tools. Users are unable to skip required forms and questions.

National Western Life has also built wizards and reminders to help with applications. Plus, the carrier can quickly adjust rules on the backend. Previously, they would have considered these changes more trouble than they were worth.

These results, plus improved processing time and sales suitability, have impressed key stakeholders. Plus, FireLight has made National Western Life’s distribution partners happy.

“Feedback from distribution has been very positive,” added Mercer. “FireLight makes their lives easier. Our partners prefer it to other systems they have been exposed to. One reason is FireLight lets them add their own forms based on their specific back-office needs.”

With FireLight, National Western Life can add forms that display only for a specific firm. This streamlines things for distributors and offers customization for their unique operations.

Looking Down the Road

National Western Life is not done yet. The carrier plans to expand its use of FireLight to improve its processes even more.

For example, they plan to add more rules to help streamline new business processing. Additional rules speed up applications and reduce user frustration. Plus, they help prevent different answers to similar questions on different forms.

The carrier also plans to remove overlapping form questions. This will make fuller use of FireLight’s capability to pre-populate known information. They plan to reduce NIGOs by including error messages and making it harder for advisors to make mistakes.

National Western Life also plans to start using FireLight Illustrations to streamline the flow from illustration to e-Application. Using the illustration tool within FireLight will provide a single, consistent user experience. Advisors can manage the entire process within one workflow. And, the carrier can use the same system to self-manage both experiences.

"We’re looking forward to expanding our use of FireLight with other capabilities in the future.”

~ Chad Mercer

Ultimately, National Western Life wants to get to a comprehensive wizard-centric experience. They want fewer mistakes and faster processing. They want a similar user experience across its different life and annuity products.

All of National Western Life’s major products are already on the FireLight platform. Distributor adoption has gone up every year since they implemented FireLight. National Western Life’s leadership has noticed and likes the direction things are going. Moving forward, new products will be launched as e-Application submission only.

Years into National Western Life’s use of the platform, the team still praises FireLight for allowing the carrier to seize control of its own administration. FireLight allows for what the National Western Life team refers to as “hands-on in-house capabilities.”

“FireLight’s self-admin tool has made it easier to process business,” said Mercer. “The process is the number one thing, even ahead of the product. Our agents get a faster, more streamlined process. It’s easier than ever to do business with us.”

“We’re looking forward to expanding our use of FireLight with other capabilities in the future,” Mercer added.

Control Your Process

Want to take control of your e-application workflows? Hexure can help with FireLight self-management admin system.